CMS 2014 “Call Letter” Response

- Aug 22, 2014

- 3 min read

Despite Revenue Reduction, Medicare Advantage Remains Good Investment

Foundational Requirements for Success Remain Same County-by-County Feasibility Review Essential for Start-ups Risk Coding and STAR Rating Rules Tightened

Every year when the Centers for Medicare and Medicaid Services (CMS) issues their annual Final Notice of Methodological Changes for the coming year (informally known as the “Call Letter”), industry analysts scramble to evaluate the financial impact to Medicare Advantage health plans. This year, in spite of the CMS press release stating that there will be an average increase of .04 percent[1] in revenue year-over-year, there is a general consensus that there will be an average revenue reduction of approximately three percent for 2015.

This annual process inevitably leads to the question, “Is taking on risk for Medicare Advantage still a good investment?” Our position has not changed; we believe the answer is “yes,” if health systems with “high-performing” networks have strong primary care alignment, programs that support preventative care, and robust chronic condition and post-acute care management. In the right situations, Medicare Advantage will continue to provide health systems with a better strategic and economic model than traditional fee-for-service and/or the Medicare Shared Savings Program.

The foundational requirements for a successful Medicare Advantage plan remain the same, and, if anything, CMS’ 2015 regulatory guidance only intensifies the argument.

We will touch on three specific areas for consideration based on this year’s CMS guidance: geography, revenue development, and cost of care management.

Geography

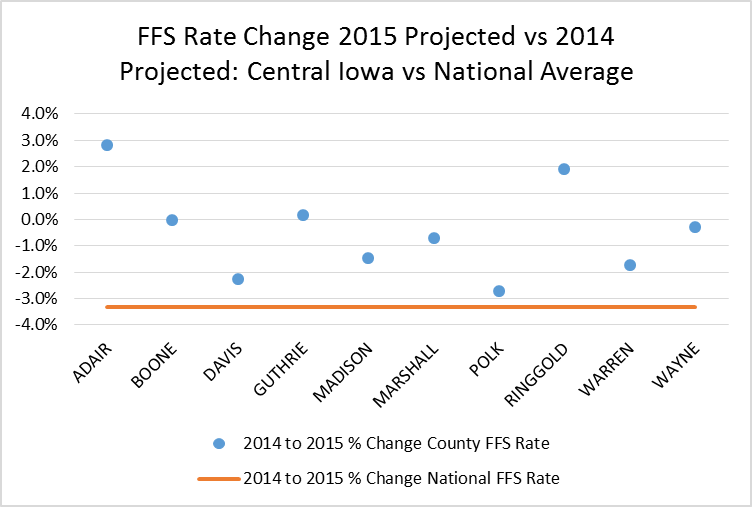

No two Medicare Advantage geographies are alike. The general consensus is that the average revenue reduction for 2015 will be approximately three percent, but the actual annual revenue changes vary greatly by geography. CMS utilizes Medicare fee-for-service claims costs to benchmark each county’s projected costs and utilizes the benchmark as a baseline for developing Medicare Advantage rates. We strongly encourage a county-level review for any markets where you are taking on, or considering taking on, Medicare Advantage risk at any level. The following are three regional examples offering a comparison of baseline revenue for 2014 vs. 2015, illustrating that each county will be impacted uniquely by the 2015 regulatory guidance:

Worse than Average

Better than Average

Average

Revenue Development

There are two critical factors that drive Medicare Advantage revenue development: STAR ratings[2] and risk coding. CMS is discontinuing the Quality Bonus Payment demonstration program as of December 31, 2014, which means that only 4 STAR rated plans and above will be eligible for Quality Bonus Payments going forward; new plans will receive a 3.5% bonus. CMS will also begin canceling all plans that have not achieved a 3 STAR rating for three consecutive years.

In addition to a revenue bonus, 5 STAR plans have the advantage of being allowed to market their products year-round. In 2014, 14 plans received a 5 STAR rating, of which 13 were provider-owned plans.[3] Effective risk coding continues to be essential to Medicare Advantage revenue development. Risk coding is a fundamental component for calculating individual rates for Medicare Advantage members. Accurate coding can make the difference between making and losing money; therefore, ensuring physicians are supported to meet these requirements is also critical to long-term success. For 2015, CMS is again raising the bar on risk coding, as health plans and provider networks have become more proficient. This year, CMS confirmed that the “coding intensity adjustment” will be increased by .025 percent, which will negatively impact revenue in 2015.

Cost of Care Management

As always, managing healthcare costs is required. Medicare beneficiaries consume on average three times the amount of healthcare services that commercial populations consume.[5] Ensuring that a robust chronic condition management program is in place, addressing patients’ total cost of care, from prevention to pharmacy costs to post-acute care, is mandatory for success. Having a care model designed to manage the senior population, specifically, is a prerequisite. We encourage a thorough capabilities review and adoption of a model that drives continual improvement when taking on Medicare Advantage risk.

As the focus shifts from evaluating the impact of the recent CMS regulatory announcements for Medicare Advantage 2015, back to how best to serve the healthcare needs of Medicare beneficiaries on a daily-basis, the elements for success remain the same. Medicare Advantage risk offers any committed provider organization an opportunity to share in the value that they create serving Medicare Advantage patients through their aligned network. There remains a viable opportunity to replace the traditional health plans with “high performing network” plans, an attractive alternative to watching Medicare fee-for-service revenue continue to erode. Careful planning and a sound feasibility assessment is a prerequisite for any provider organization planning to apply for the Medicare Advantage program.

[1] “CMS Ensures Higher Value and Quality for Medicare Health and Drug Plans,” April 7, 2014

[2] The majority of the critical STAR rating measures are derived from HEDIS and CAPHS scores

[3] CMS 2014 STARs data

[4] “CMS Ensures Higher Value and Quality for Medicare Health and Drug Plans,” April 7, 2014

[5] Health Care Costs – From Birth to Death, Society of Actuaries, 2013

Comments